Risk Assets Continue the Party: Global Central Bank Outlook still Dovish Despite Mixed Data

In this macro series, we explore central bank outlooks, meme-coin mania, ETF inflows, and more.

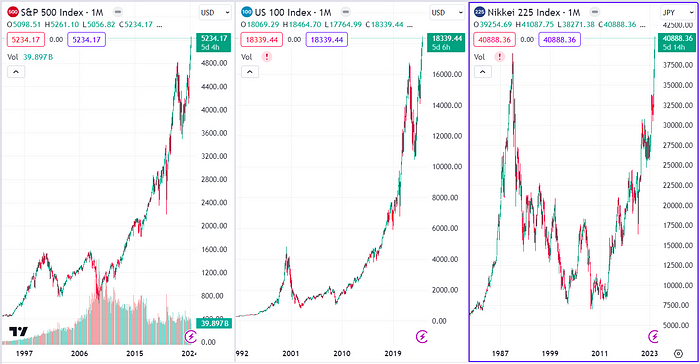

The everything rally that started in Oct 23 has continued in Q1 24, and risk assets have enjoyed great returns with SPX, NASDAQ, Nikkei and BTC at all time highs! Risk assets have been pricing in a global easing impulse in the monetary cycle so all future 2024 performance depends upon incoming data and how it affects probability of rate cuts, easier monetary policy and available liquidity.

All time highs for S&P500, NASDAQ and Nikkei

Economic data over the last couple of months has been a mixed bag and forced an exuberant market to pare back expectations of 6 rate cuts in 2024 to 3. Inflation data was higher than expected for both Jan and Feb and dashed any hopes of a quick return to the Fed’s 2% inflation target. It also opened up risks that inflation might pick up further. On the other hand, there are signs of economic slowdown. The rebound in consumer sentiment stalled, retail sales numbers suggest consumer spending impulse seems to have waned and the labor market has started to show cracks under the surface.

Thus the FED needs to perform a fine balancing act- keeping things tighter for longer may lead the economy into recession, while cutting too soon may lead to runaway inflation again.

FOMC Meeting

Fed messaging from the march FOMC meeting took on extra significance against this backdrop and market participants derisked going into the meeting. Expectations for a March rate cut had already been priced out and the Fed held rates. Fed projections remain accommodative (Dot plot still projects 3 rate cuts in 2024, but 3 in 2025 instead of 4 earlier while the inflation forecast for 2024 was changed higher to 2.6% from 2.4% earlier) and Powell struck a very dovish tone in his press conference. When asked about inflation, he stressed that they will reach the target “over time”, which means that the Fed is willing to let inflation run higher than its 2% target for longer and will still be inclined to cut rates (“at some point this year”) as long as inflation doesn’t pick up materially from where it is now. The pace of balance sheet reduction (Quantitative Tightening) will also slow down “fairly soon”, another dovish message to the market.

Thus the messaging from the FED has changed. Last year the message was that inflation is priority, they will hike and bring it down even if the economy crashes into a recession. This time the message is that inflation has softened significantly and even though its not at target yet, if they can avoid a recession, they would prefer to avoid it as long as the inflation trajectory is ok. Predictably, risk assets took the news positively and rallied.

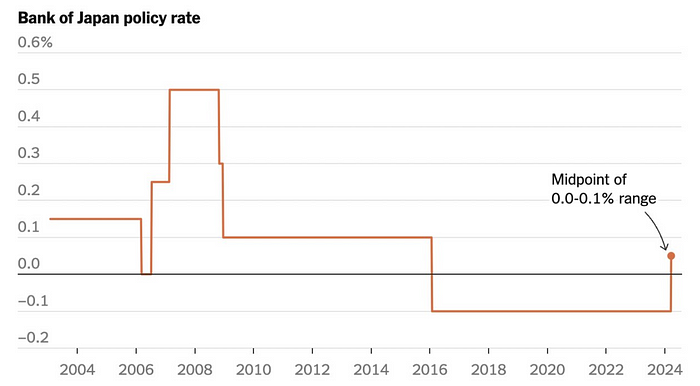

Bank of Japan Historic Change

Meanwhile, the BoJ also held a historic meeting when they hiked for the first time since 2007 by 0.1% and exited the last global negative interest rate regime. They also ended their YCC (yield curve control) and risk asset buying program. Going into the event, market participants were apprehensive about the trajectory of future tightening but the BoJ put all those fears to rest by indicating that they will remain accommodative going forward.

This was positive for risk assets as Japanese monetary policy has an outsized impact on global financial markets. The BoJ owns about half of all outstanding JGBs (Japanese govt bonds) and about a $250 Bio equity portfolio! Japan has also been a significant source of liquidity for the world and the Japanese own about $4.2 trillion of foreign assets. (The yen carry trade has been the biggest expression of this dynamic, rates in Japan are cheap, so people borrow cheap JPY and invest in higher yielding assets abroad) Significant tightening can reverse these flows and negatively affect global assets, but BoJ messaging from this meeting was positive and averts that risk.

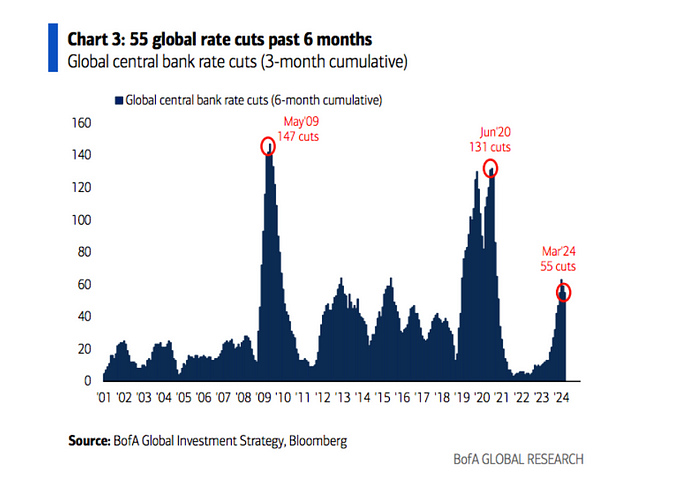

Global Central Bank Dovish Pivot

Other central banks are also moving towards more monetary accommodation. The global cutting cycle got going in earnest with a surprise cut from the Swiss National Bank (SNB) as they became the 1st G10 central bank to cut rates in an effort to preempt the FED and ECB cutting cycles and get some breathing room by weakening CHF.

Bank of England (BoE) has also turned the corner in the cycle and transitioned by removing all probability of hikes. They held rates on Thursday with an 8–1 committee vote with 1 in favor of cuts which removed hike risks (last meeting still had 2 members in favor of hiking rates) and with messaging that they will transition to cuts later in the year.

European Central Bank (ECB) is expected to start cutting rates in June while People’s Bank of China (PBoC) is already cutting amidst stress in the Chinese economy. Thus this coordinated global easing impulse is well underway and is a significant tailwind for risk assets.

Crypto

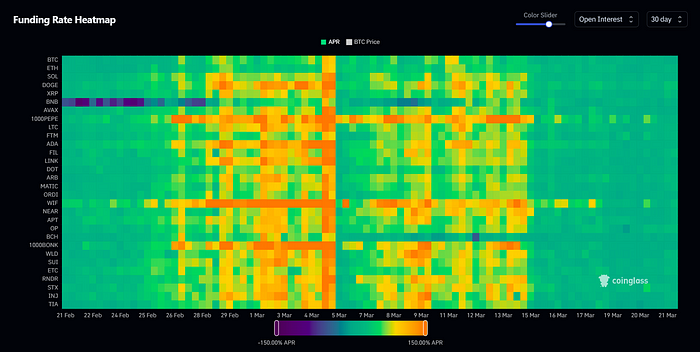

After a scorching multi month rally that saw BTC set new all time highs, significant multiple gains in alts and continuously elevated levels of funding rates, the rally took a breather and BTC retreated to the 57–61k support band.

This pullback was a healthy correction and funding rates reset across the board amidst a leverage flush from the system.

The rally should continue further if BTC can take support from the 57–61k level with a favorable macro backdrop and upcoming halving as catalysts. One of the most important variables for continued BTC strength though are ETF inflows.

BTC ETF Inflows

BTC spot ETFs have without doubt, been one of the most successful ETF launches of any product, and have gathered ~$12 bio in assets in 2 months which has contributed significantly to the BTC Q1 rally. The most successful amongst them has been Blackrocks IBIT, while Grayscale’s GBTC has continuously bled assets due to high fees. The ETFs have also increased crypto correlation to tradfi risk assets, and macro events like the pre FOMC risk off contributed to net outflows this week. Going forward as well, its expected that BTC flows will be correlated to macro sentiment and positioning which will play a major role in price trajectory of crypto.

ETH ETF Probability Repricing

ETH had been rallying over the last 2 months and reached $4100 with speculation around ETH Spot ETF approvals in May. However over the last couple of weeks, the market has started pricing in an increasing likelihood of delay in May (for May approval, Bloomberg ETF team probability has come down to 25% vs 60% in Jan) as the SEC hasn’t engaged with ETF issuers. Moreover the ETH foundation has been subpoenaed by a gov entity (with rumors flying around that the SEC is trying to get ETH classified as a security) which is bearish for immediate ETF approval. This has been a headwind for ETHUSD which retreated to 3100 before bouncing back after FOMC. Current pricing assumes an end of 2024 approval which could be fuel for another strong rally later in the year.

Blackrock Digital Asset Fund

Another major development this week was the announcement by Blackrock of a $100 mio digital asset fund in conjunction with Securitize(with token BUIDL on ETH). Although its not clear what assets the fund will hold, this is another important step in acceptance and adoption of tokenized assets as well as crypto as an asset class by mainstream investors and will lead to newer tradfi capital coming into the space over the next few years.

Coinbase DOGE, LTC and BCH Futures Filings

Another regulatory event was the filing of certifications with CFTC to list US regulated futures for Dogecoin, Litecoin and Bitcoin Cash by Coinbase Derivatives LLC. These futures will start trading 1st April if there are no objections and cements the status of these assets as commodities rather than securities.

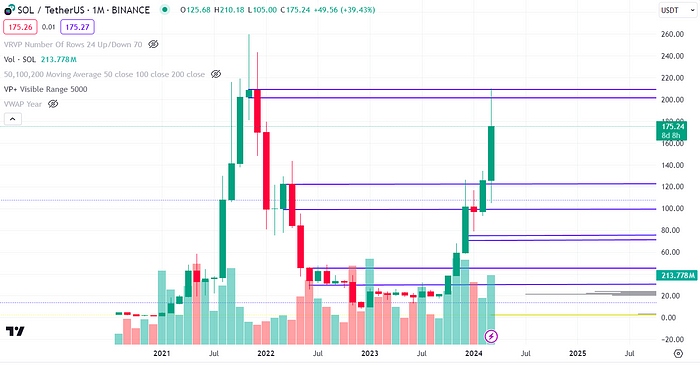

SOL

SOL is one of the strongest alts and has been on a monstrous rally, doubling just in the last 1 month alone. It has maintained relative strength even when the broader market has retraced and with a current FDV of $100 Bio, its caused a massive wealth effect in the ecosystem that has led to rallies and froth in all SOL assets, especially memecoins.

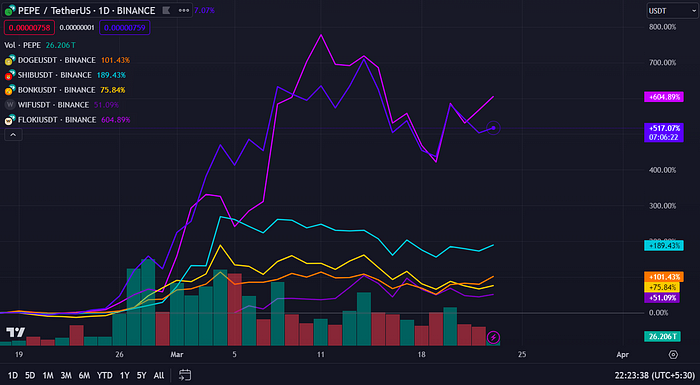

Memecoin Mania

There has been a raging memecoin mania on multiple chains, but especially solana over the last couple of months with tokens such as BONK, WIF, BOME, reaching multibillion FDVs.

Risk appetite became so extreme that there have been more than $150 mio of scams and rugs on solana alone in the last couple of weeks, with people sending funds to random influencers without a team/product or any fundamentals. With sentiment at such extremes of greed, the current pullback and a consolidation in the broader crypto market is healthy to reset leverage and build a base for the next leg up.

Read more from the author (and our macro researcher), Fractalmonk: https://medium.com/@fractalmonk999

Avantis is a an onchain leveraged trading and market-making platform. Trade cryptocurrency, forex and commodities with up to 100x leverage, or power trades on the platform as a liquidity provider. Avantis gives advanced risk management tools to traders and liquidity providers for the use and provision of trading leverage. Avantis is built on Coinbase’s Base blockchain, and is backed by industry leading investors such as Pantera, Founders Fund, Galaxy Digital and Coinbase Ventures.