A very big company could be created in a category everyone is ignoring: the elderly

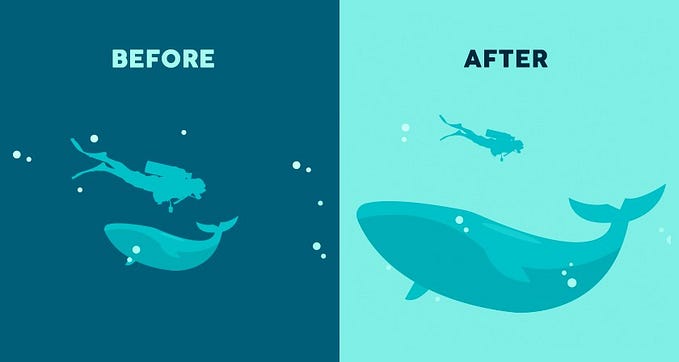

The elderly is probably one of the soon-to-be fastest growing online markets in many developed countries. This becomes more obvious when looking at the increase in life expectancy and the shape of some countries’ population pyramids, especially in western Europe and some Asian countries, like Japan and China. You can have some fun playing with the different geo areas here.

Online penetration is increasing at a fast pace among seniors, so senior citizens are more and more likely to buy online. Also, they are not the only ones purchasing the items they need, but their tech savvy children contribute to domestics tasks. They all prefer the convenience of online shopping and home delivery. Indeed, the older population struggles to carry bags from grocery stores to their homes, and the new family structure proves different generations are likely to live in different cities and countries.

This got me thinking about how focusing on seniors makes sense in very different verticals — pensions, insurance, fintech more broadly, healthcare, even social and entertainment, among others. I also couldn’t help thinking about the direct-to-consumer landscape given the time I’ve spent looking at this space. I tried to find direct-to-consumer brands focused on seniors, but I barely came across any. Maybe I wouldn’t have made a good CIA agent, or maybe there aren’t many out there. It’s interesting how some categories are only getting more and more crowded, while there are some markets that still need huge reinvention. Opportunity, I call it.

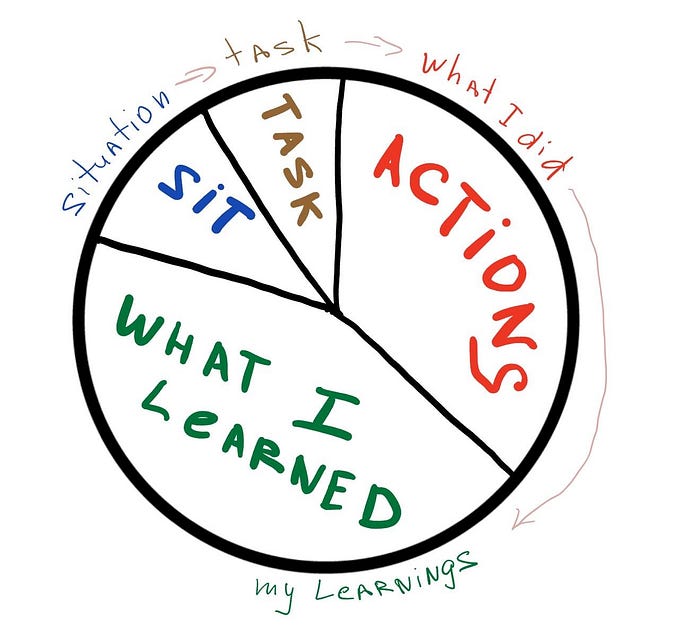

Back in the summer I published a framework on how to holistically look at DNVBs. I won’t go to that level of detail in this post, but I’ll briefly explain why I think launching a DTC brand in this category makes sense. I’ll focus on one product that I find particularly interesting: diapers for seniors.

Unsexy, I know. But those markets are often the ones where big opportunities can be found.

The market

- Big and growing, as anticipated above (population pyramid, online penetration, longer life expectancy)

- Very concentrated market with very few players producing diapers for seniors and mainly distributing through pharmacies and limited offline stores (see the selection on Amazon as a good reflection of how the offer is quite limited)

- Low focus on marketing and brand in a category where customers could easily feel very attached to an emotional story (and product attributes)

Top line

- Very high volume market with seniors spending c.$2.5+ / day (c.$75+ / month) in diapers (assuming a usage of 4 diapers per day) which is more attractive than the average spent in most other DNVB categories

- Incredible high repeat (frequency of purchase)

- High conversion potential

- Low churn expected / high retention (especially if brand emotional connection is strong and product is offered at the right price point)

- Expected low engagement, but with potential for increase over time

Profitability

- Gross margin at scale of c.70%

- No returns

- CAC should be relatively low for first market entrant, especially if launching strategy is well thought

- High efficiency and diversity of acquisition channels (online and offline, including unsaturated channels)

- Payback and CAC:LTV should be attractive given the above assumptions

- Supply chain costs not particularly higher, and despite slightly bulkier distribution, weight stays manageable, with no special delivery requirements

Other considerations

- Value of convenience is huge. Consumers don’t enjoy purchasing diapers for seniors, it might be even embarrassing for some people. It’s also an inconvenient purchase to make today given it’s a quite bulky item

- Perfect to buy online (online trigger). Consumers don’t try a diaper before they buy it and there is no benefit of having a physical interaction with the product

- Excellent product for subscription given all the above points and the recurrence of purchases

- Huge relevance of branding potential with no player currently capitalising on it. There is no reason for branding to be more relevant on the babies’ diapers market than on the seniors’ one. I’d argue emotional connection could be even higher for products for the elderly

- This product is not a ‘nice to have’ but a must have for the target audience, and therefore recession resilient and with even lower churn risk

I look forwards to seeing more companies focusing on this market and caring about providing better products and services to our older population.