Passage is Live on Testnet: How to Start Trading

How to use get started on Passage testnet

Passage is a breakthrough product for trading long/short volatility. For the first time, traders can take positions on volatility ranges on top assets like BTC without bias for price direction in a simple and intuitive way. Traders can use the default range or set custom limits and place “STAY IN” or “BREAKOUT” orders.

Connect your wallet

Head on over to https://test.bracketx.fi to connect your wallet when prompted.

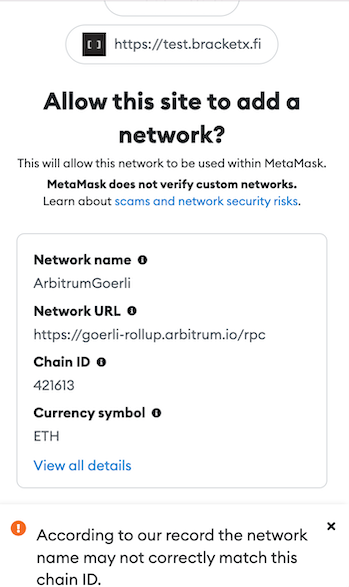

Add network

Connect to the Arbitrum Goerli Testnet ChainID 421613 by allowing the site to add the network.

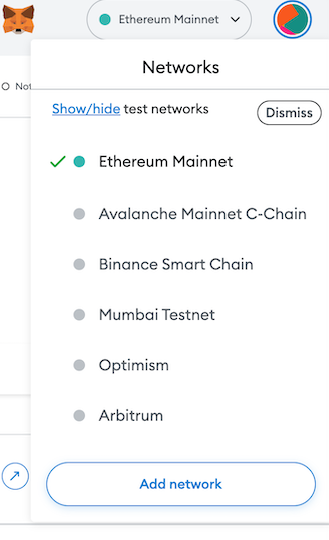

Manually connect to Arbitrum Goerli testnet

If you need to manually connect, please use the following steps to add to the network.

Click on the Networks dropdown at top and select “Add Network”

Enter the following into the settings fields:

- Network Name: Arbitrum Goerli Testnet

- *RPC URL: https://goerli-rollup.arbitrum.io/rpc

- ChainID: 421613

- Currency Symbol: ETH

- Block Explorer URL: https://goerli-rollup-explorer.arbitrum.io/

- Token Bridge: https://bridge.arbitrum.io/

Get some test ETH on Arbitrum Goerli Testnet

To use BracketX as a buyer, you will need some ETH on Arbitrum Goerli Testnet. To get it, there are two recommended ways:

- Get Goerli ETH from public faucets and bridge from L1 to L2 (examples: Alchemy Goerli faucet or Mudit Goerli faucet)

- Request 0.075 ETH on Arbitrum Goerli from our Discord #faucet channel

To get ETH from the public faucet, follow these instructions:

- Go to Faucet Goerli: https://goerlifaucet.com/

This may require an Alchemy login - Add in your wallet address and click “Send me ETH”

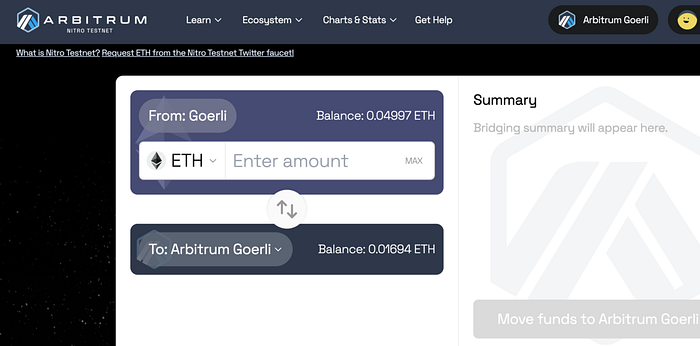

You will receive some Goerli ETH. Remember, you are getting ETH on the Goerli testnet, not Arbitrum Goerli testnet - Go to: Arbitrum Bridge

Make sure you bridge from Goerli ETH (L1) to Arbitrum Goerli (L2) as indicated below. Once you enter the amount, click “Move funds to Arbitrum Goerli”

This transaction will take about ~15 min to process

Buy a Passage

On the app ( https://test.bracketx.fi) let’s get started with our first buy!

Select an Asset

Once connected to BracketX testnet, you should see “Passage” on the top of the screen

Your navigation is at the top of the page on the desktop version. Make sure you are on the “Passage” page. Click the “BUY” button.

Next, you will find a drop-down with the asset (only BTC and ETH are on testnet right now) as well as the current market price.

Let’s select BTC in the dropdown:

Choose a side

Passage creates a range based on the current asset price and allows traders to select “STAY IN” or “BREAKOUT.” Passage will provide a DEFAULT RANGE, which is an algorithmically determined range based on recent volatility, or allow traders to set custom ranges with a CUSTOM LIMIT ORDER. While all Passages are limits, custom limits are outside of the default range (more on that later).

Place an order

Placing your order starts with understanding the range. Let’s take a look at the passage range and how it works:

The passage chart will show you two very important pieces of information. First is the RANGE of the passage. In this example, it is $27,157 at the top end and $26,513 at the bottom. These are the breakout points. You will also see a percentage in the upper right-hand corner of the chart indicating the % width above and below the spot price for the range itself. In this example, the range is 1.2% above and below the spot price.

The second piece of information is the PAYOFF. This is represented as a green line with brackets at the ends. The payoff of a passage is based on TIME. To learn more about that, check out our detailed explanation HERE.

You will see since we selected a STAY IN, the payoff starts at $0 and accumulates based on time in the range, while a BREAKOUT would be the inverse, starting at $200 (2x) and losing value over time. On a 2 Day Passage, your breakeven is 1 day.

In Passage, the default trading market is denominated in ETH. However, there will be future markets denominated in other cryptocurrencies like stETH, ARB etc.

For this example, we are in the ETH market and can enter our ETH investment.

After choosing a side, enter the amount you want to trade. You can enter in dollar amount or in ETH using the green selector button to swap if necessary. Let’s enter $100 (0.0643 ETH at the time of purchase). Once we do this, we will get a prompt that tells us in plain text what our position entails.

- Good-until Canceled: Order will remain OPEN until canceled or filled

- All contracts are 2-day

- “STAY IN” position accrues from $0 over time and max out at 2x

Setting slippage

Slippage is automatically set to 0.1%, which means your order will subtract 0.1% and fill more easily if there are orders close to yours. You can toggle this feature on and off before placing your order.

Trade with an existing balance

If you have funds on the smart contract that have not been withdrawn, Passage will ask you if you would like to use them toward a new trade. You can toggle this on or off.

Buy

Once your range is set you can press the BUY and confirm your transaction in your wallet.

Purchase Successful

Upon purchase, you will receive the following message with a link to your transaction as well as a field to enter your email for alerts/updates.

Placing a Custom Limit Order

The second type of order on Passage is a CUSTOM LIMIT ORDER. This is for traders who want to order custom ranges that are outside the current default price.

To place a custom limit order, select the ⚙️ icon on the payoff

The “+” and “-” buttons widen or narrow the range 0.1% above and below spot, while the “++” and “ — “ icons move the range a full 1.0% above and below spot.

Liquidity Depth

To check your order against the market, navigate to the liquidity depth section using the selection to the right of the BTC price chart:

- The dotted line represents the default market-suggested price

- The green bars to the right of the dotted line are “STAY IN” trades, which are “wider” ranges

- The red bars to the left of the dotted line are “BREAKOUT” trades, which are “narrower” ranges

You can use the arrows at the top right of the screen to scroll right or left and the middle button to return to the center.

Buy custom limit order

Once your range is set you can press the BUY and confirm your transaction in your wallet.

Purchase Successful

Upon purchase, you will receive the following message with a link to your transaction as well as a field to enter your email for alerts/updates.

My Trades

The My Trades page will show ALL trades, ACTIVE or CLOSED. It will also be the place for you to CANCEL or SELL your orders. To get there, click on the MY TRADES button at the top of the screen

Passage has three main statuses for trades, ACTIVE (filled), ACTIVE (unfilled), and CLOSED. Active trades will be the default view.

My Active Passages

Select between ACTIVE or EXPIRED Passages. Control the sort order via the dropdown list. The totals are based on all available data, but the view of onscreen transactions is limited to the last 1,000 records.

Portfolio Stats

My Trades will display stats at the top of the page that include the following:

ACTIVE VALUE: The total estimated value of all your active holdings.

INVESTMENT: The total investments you have made

PAYMENTS/PAYOUTS: The payouts that have been made to you

UNFILLED: The number of investments that have not yet been matched and can still be canceled

PROFIT: The profit and loss, which is payments PLUS the market value of the open positions PLUS the unfilled amount MINUS the investment made

#ACTIVE/#TOTAL: The total number of investments shown with ACTIVE / TOTAL

Understanding your Trades

Each trade will have several fields that show exactly what is happening.

Example BREAKOUT Order

- ASSET: BTC or ETH

- WIDTH LIMIT: if a limit order was made, the range of the limit. In this case, a <1.3%

- STARTED: when the order was made and a link to the transaction receipt on-chain

- AMOUNT: The total order size

- ESTIMATED VALUE: Total estimated value of the order based on the Passage fair value pricing model

- STATUS: this order is a FULLY FILLED position that is still active i.e. has not settled/broken out yet

Order Fills

By clicking the white expansion arrow, we can now see the ORDER FILLS associated with the main order.

Here, the BREAKOUT filled in one single order, which belongs to Passage #17 with a cost/trade size of $25.08. We will then see the ESTIMATED VALUE of the individual order fill, which happens to be the same as the total estimated value as there was just one single fill.

Each fill also includes a simple price chart with the breakout points of the position as well as the current price as represented by the white arrow within the brackets for reference. Lastly, we will see an expiration date and the time elapsed since purchase. These data give us better insight into the profitability of the position.

Example Trade with Multiple Fills

In some circumstances, your trade may fill in MULTIPLE independent fills with different ranges. In the ORDER FILLS expansion, you will see these records with their individual ESTIMATED VALUES as well as current price charts and expirations.

Payouts

If an ACTIVE order is filled in whole or in part and subsequently settles due to a breakout or expiration, a payout may be triggered.

Payouts will appear beneath ORDER FILLS on ACTIVE orders if part of the order is still and beneath the trade itself on CLOSED trades. Let’s check out an example of a CLOSED trade.

Payout fields include the CONTRACT ID, and receipt of the payout, the COST of the position, the PAY TIME, RANGE, and RECEIVED amount. Conveniently, we also include the PROFIT for order. Remember, a larger order may have MANY individual fills and therefore MANY individual PAYOUTS.

Selling an Active Order

When an order is still active, you may be able to SELL the position to the Passage vault, which will typically make OFFERS at a discount to the current estimated fair value price. You may want to try to sell if you feel the trade will not expire in profit or if you are in profit and want to lock in.

Example of a Sell

Let’s take a look at a BREAKOUT order that has FULLY FILLED but we want to sell out of the position.

The Passage Vault may make you an offer, which will be at a discount to the estimated fair value price. In this example, you are being offered $16.81 as the position is already out of profit. The amount offered can change and will vary based on market conditions and the status of the vault.

Accepting the sale will trigger a wallet confirmation and a PAYOUT.

Canceling an Order

You can CANCEL an order if the trade has not yet been filled. Even if a portion of the order has been filled, you can cancel a part that has not been filled. Use the green button next to the order to cancel the unfilled amount:

After hitting CANCEL, you will confirm the transaction in your wallet and the remaining outstanding order will show a PAYOUT with a CANCEL.

My Account and Withdrawal

Passage has a MY ACCOUNT page where you can withdraw funds that are released from contracts.

Once you are on the My ACCOUNT page, you can select WITHDRAW for any available funds. This will trigger a wallet confirmation and a withdrawal will be initiated. If you choose to leave funds in the contract, they can be reused for future Passage purchases.

Ready to Try?

We are excited to let you all get familiar with Passage and provide feedback prior to our mainnet launch. If you have any questions, comments, or suggestions, please feel free to ask them on our Discord.

After getting your test ETH, try testnet testnet at : https://test.bracketx.fi/buyer

— Bracket Labs Team