EOQ Fundamentals: A Guide to Inventory Efficiency

Data Mastery Series — Episode 15: The Art of EOQ (Part 1)

Connect further and follow my journey: linkedin.com/in/nattapong-thanngam

As we continue our exploration of supply chain management, let’s take a moment to recap our journey so far:

- EP1 Basics of Time Series: Explored core forecasting algorithms, dissected the fundamentals of time series, and evaluated metrics.

- EP2 Descriptive Analytics (Part 1): Emphasized the role of historical data and its visual representation.

- EP3 Descriptive Analytics (Part 2): Delved into metrics of centrality, variability, and localization. Showcased Python tools for efficient data analysis.

- EP4 Visualizations for Forecasting: Highlighted graphical representations including line charts and decomposition plots tailored for time series data.

- EP5 Sales Forecasting: Integrated insights from prior sessions to delineate key sales forecasting methodologies.

Continuing our Tale

Now, as Zara’s coffee shop enjoys success and expansion, she faces the challenge of optimizing her stock and inventory management. To tackle this, she seeks the expertise of Donato, a supply chain management specialist.

Imagine you’re in Zara’s shoes. How would you handle inventory? What’s the ideal volume and frequency for ordering raw materials? How can you prevent overstock or shortages? In this episode, we’ll introduce the concept of Economic Order Quantity (EOQ).

From Episodes 1 to 5 of “Time Series Forecasting,” the focus has been on the “Coffee Cafe” to “Sales to Customers.” For this episode, we will shift our attention to the supply side of the “Coffee Cafe”.

Note: After much trial and error with MidJourney, I managed to craft the infographic showcased above. Kudos to perseverance! ^__^

What is EOQ

The Economic Order Quantity (EOQ) is a calculation used to determine the optimal order quantity which minimizes the total inventory holding costs and ordering costs. It’s pivotal for inventory management, helping businesses ascertain the most cost-effective quantity to order.

Formula: EOQ = √(2 * D * S / H)

Where:

- D = Demand rate

- S = Ordering cost

- H = Holding cost per unit

Benefits of EOQ

Implementing EOQ offers several key benefits to businesses:

- Minimized Costs: EOQ reduces the total cost by balancing ordering and holding costs.

- Inventory Efficiency: Helps maintain an optimal inventory level, preventing overstock or stockouts.

- Enhanced Cash Flow: By optimizing inventory, capital isn’t tied up in excess stock.

- Enhanced Customer Satisfaction: Consistent availability of products ensures customer satisfaction.

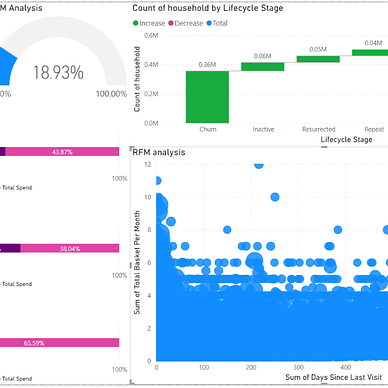

The figure above illustrates the EOQ point where ordering and holding costs balance out. Let’s delve deeper:

- Ordering Cost: Covers all costs associated with order placement, including administrative charges, inspection fees, and shipping.

- Holding Cost: Captures expenses of storing inventory, including warehousing (rent, utilities), insurance, and applicable taxes.

Before diving into the calculations, let’s establish our assumptions for ordering cost, holding cost, and unit price, which are detailed in the following table. With these parameters in place, we can determine:

- Economic Order Quantity (Q*): The order quantity minimizing total holding and ordering costs.

- Cycle Stock (Alternatively known as Cycle Inventory): The average inventory anticipated to be sold during one order cycle.

- Ordering Cost and Inventory Carrying Cost: Ordering cost concerns procurement-related expenses, while inventory carrying cost deals with storage-related costs.

- Average Flow Time of Cycle Stock: The typical duration a product remains in inventory before being sold.

From the table, the optimal order quantity, represented as EOQ (or Q*), is calculated at 979.8 units per order. To understand its flexibility:

- Reduced Ordering Cost: Imagine a significant project that successfully reduces the ordering cost from 4,000 to 166.67 per order. As a result, Q* would decrease from 979.8 to 200 units per order, aligning with the logic of lower ordering costs leading to larger order quantities.

- Increased Demand: In another scenario, with a sudden demand increase from 1,000 to 2,000 units per month, Q* rises from 979.8 to 1,385.64, reflecting the need for larger order volumes to meet customer demand.

Analyzing EOQ for Multiple SKUs

For our discussion, we’ll examine the EOQ for four distinct product patterns, as represented by SKUs A, B, C, and D. Specifically:

- SKU A = Growing trend with seasonality.

- SKU B = Decreasing trend with seasonality.

- SKU C = Sideways with seasonality.

- SKU D = remains largely consistent, but with sporadic demand spikes.

To simplify the EOQ concept, let’s make a few assumptions: we will assume that future demand is known, there’s no lead time. For simplicity, just SKU-A will be focused on visualization.

Step 1: EOQ Calculation

Determine EOQ and related parameters as laid out in the following table:

Step 2: Inventory Metrics

Integrate the “on_hand,” “Order_placed,” and “Order_qty” data into our daily transactions.

- On_hand: Yesterday’s inventory adjusted considering today’s sales and order quantities.

- Order_placed: A trigger indicating for inventory top-up, activated when yesterday’s inventory is less than today’s sales.

- Order_qty: The EOQ value, coming into play upon replenishment.

Step 3: Breaking Down Costs

Incorporate the “holding_cost,” “ordering_cost,” and “total_cost” metrics.

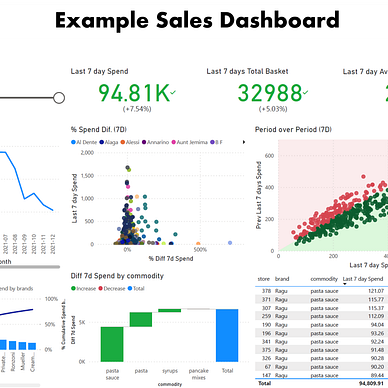

Step 4: Inventory Movement Visualization

Make an “inventory movement chart” mapping demand, order volume, on-hand items, and summary annual cost charts.

Diving deeper into SKU A’s chart for March 2023:

- By March 9th, we have just 27 units in inventory.

- On March 10th, demand escalates to 229 units, prompting an EOQ-based replenishment of 1,663 units.

- Before addressing this surge, our inventory totals 1,690 units (1663+27). After fulfilling the order, it settles at 1,461 units (1690–229).

The insights provided should bolster your understanding of EOQ in action. Here are further visualizations detailing other SKUs and their annual cost summaries:

Concluding Notes

The EOQ model has many advantages, including improved customer satisfaction and effective inventory control, both of which improve cash flow. We’ll discuss safety stock, dynamic lead times, and other topics in the upcoming episode.

Thank you for joining this insightful exploration. For more content that adds value, explore my diverse collection of articles.

Please feel free to contact me. I am willing to share and exchange ideas on topics related to data science and supply chains.

Medium: medium.com/donato-story

Facebook: web.facebook.com/DonatoStory

Linkedin: linkedin.com/in/nattapong-thanngam